A Perilous Or Promising Market?

For some years now we’ve heard a lot about how US stocks might go south. It’s now the fall of 2022 and we’ve seen the securities and negotiable instruments market find themselves in somewhat of a sticky situation so, our task is to find out if there are any papers worth investing in right now and if so, which.

To kick things off, let’s take a look at what’s been going on with the major U.S. indices over the past year.

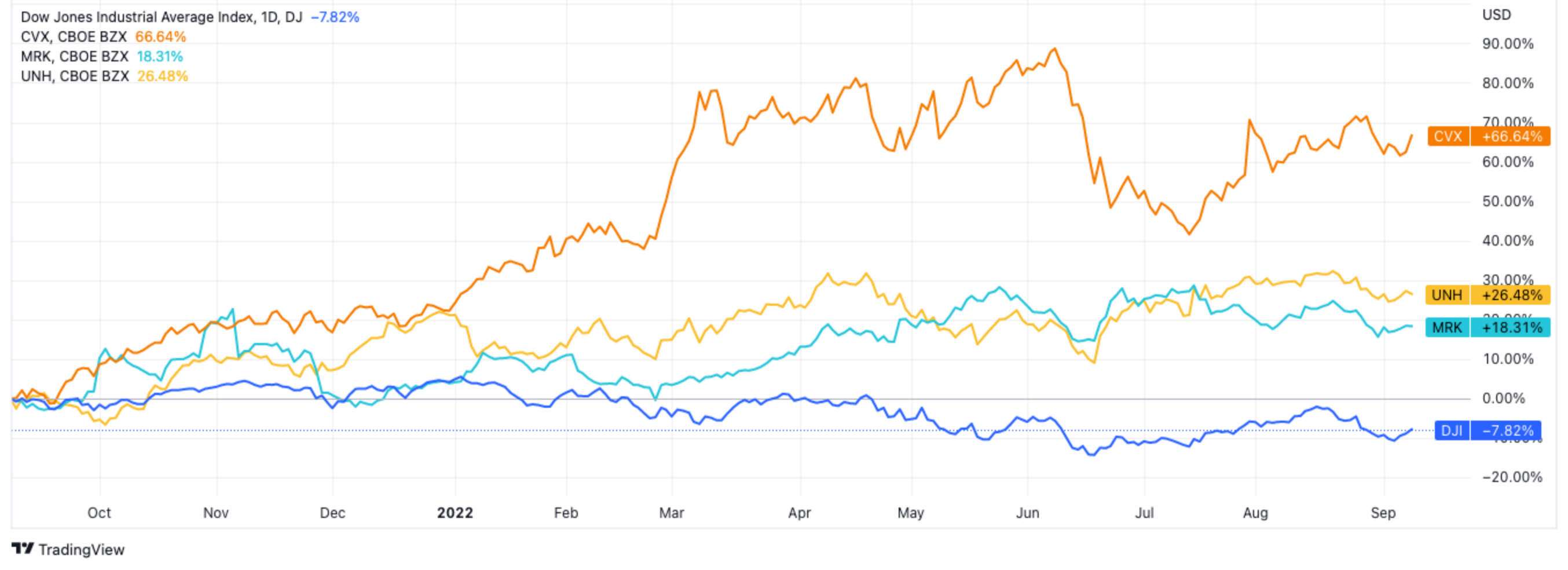

The Dow Jones Index – an investor favorite – groups together the prices of 30 of the most traded stocks on the NYSE and the Nasdaq, and has fallen nearly 8% over the year.

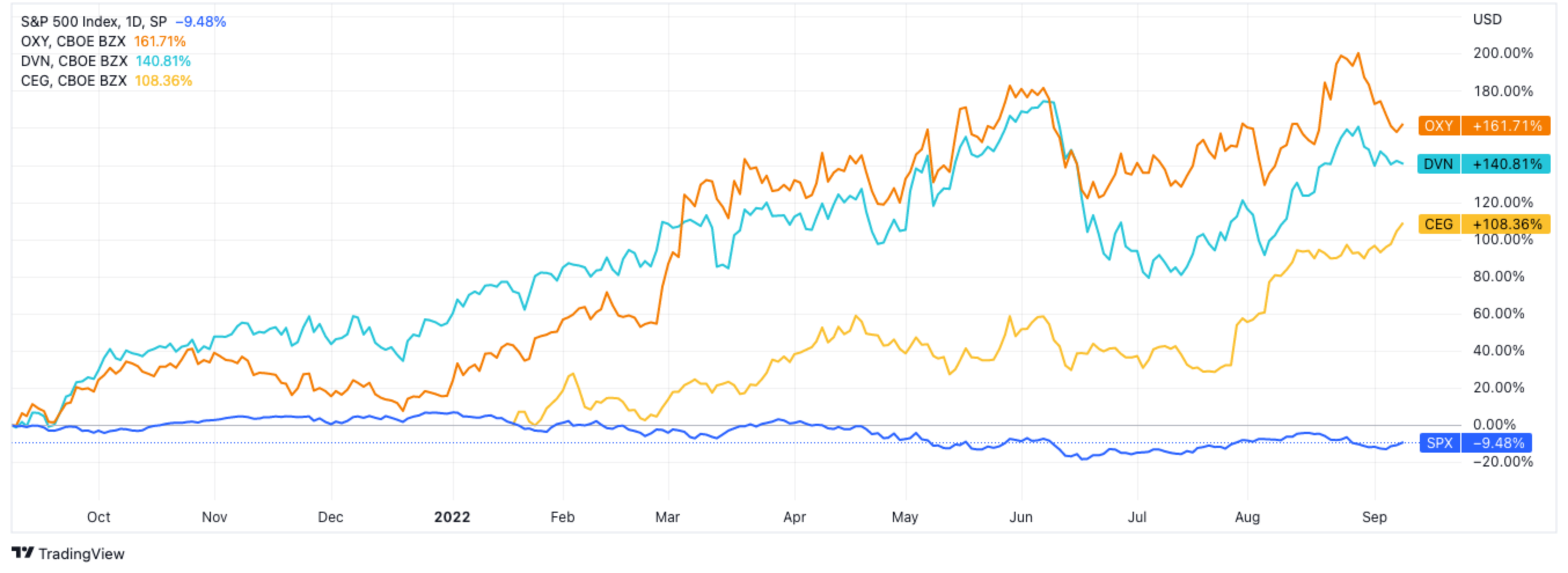

The S&P 500 index, measuring the performance of America’s 500 largest stocks, has fared even worse.

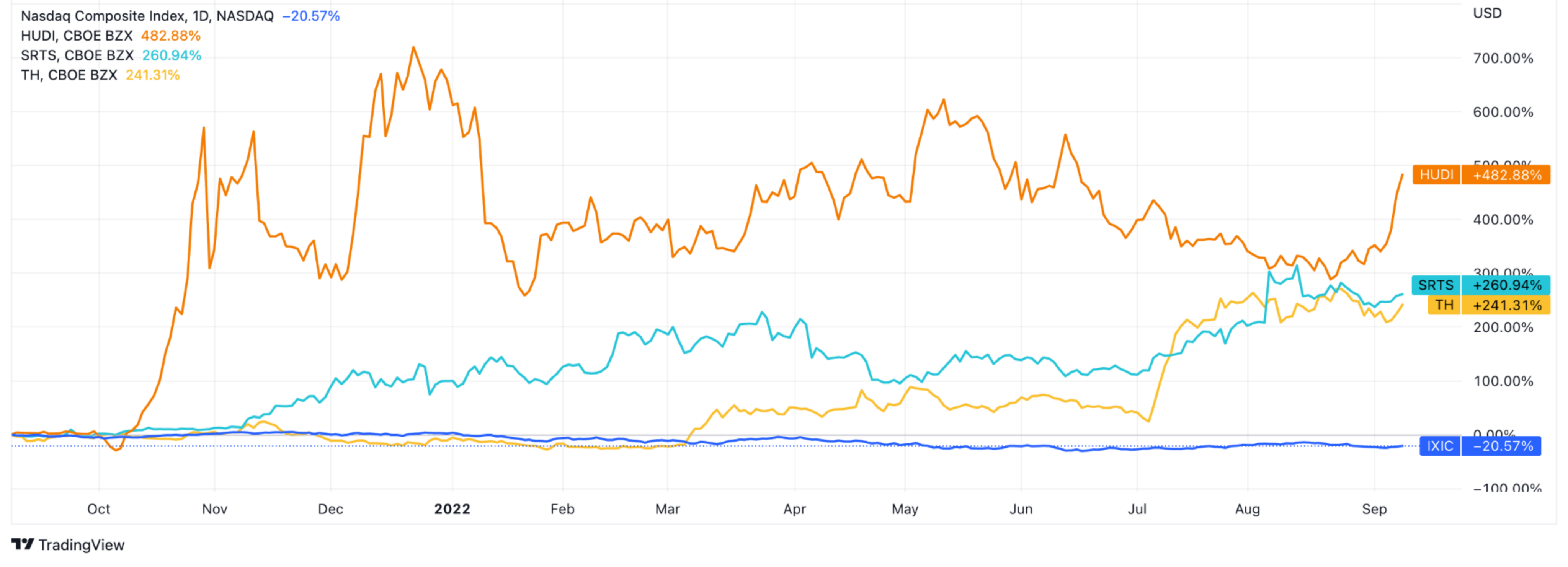

In addition to these two, the NASDAQ Index doesn’t score any top marks either with a 20% drop over the year so far.

In January 2022, experts attributed the market decline to several factors: 1) investors were waiting for the US Federal Reserve to raise the key rate 2) US companies posted worse-than-expected first and second-quarter earnings, and 3) geopolitical risks were steadily on the rise.

But, the world’s economies and exchanges had been knocked off-kilter much earlier than January. We’ve heard of the market being too inflated and have heard calls for the pop since 2019, at which point a little thing called coronavirus entered the ring and unfortunately, still hasn’t yet fully left. This and more have caused a wave of complex geopolitical situations and an energy crisis that is affecting all corners of the globe including but certainly not limited to the US.

At the same time, the world’s supply chain faced increased disruptions and pressure, leading inflation to worsen in the summer of 2022, the US inflation rate reached a 40-year high of 8.6% and the Fed started steadily hiking interest rates to try and cope with the escalation.

Some experts believe there’s worse to come. Enough to make the dot-com bubble seem like a walk in the park.

So, other than panicking, what actions can we take based on this information? Firstly, it’s a good idea to evaluate your portfolio to ensure it’s well diversified. What that means, is that it’s always key to have a broad variety of assets in your portfolio from various global markets even if you’re big in American securities, having only those in your portfolio can be limiting.

You might want to take a look at other types of assets. They can be bonds if you believe the return on them will outpace inflation, commodities like oil futures, real estate, or investment funds for example.

There is always a chance to trade on a possible market decline or securities fall. When one fights to the last ditch, another gets rich whatever the crisis, there are always individual companies or entire economic sectors that rake in profits.

As we said earlier, indices have fallen rather catastrophically over the year, by as much as 20% to mark a bear market for many. But, let’s see which stocks from these same indices are defying the decline.

While the Dow Jones Index is down nearly 8%, Chevron is up more than 60% and that’s excluding dividends!

Following Chevron in our rankings comes UnitedHealth Group, a US-based insurance company with 26% YTD gains, and biopharmaceutical firm Merck with its 18% YTD increase.

Next in line is the S&P 500. Considering it’s made up of 500 large stocks traded in the US, the difference between the index chart and the charts of the top-gainer stocks should be even wider. Another oil and gas giant, Occidental Petroleum, is at the top here up by 162%.

In second place we have energy company Devon Energy with a 141% increase, followed by electricity provider and gas supplier Constellation up by 108%. The energy sector seems to be popping, and it’s not hard to figure out why.

The Nasdaq’s leader is the Chinese stainless steel-product development group Huadi International prolly because of a bullish few years for the steel industry, though some signals indicate a tipping point there as well. Its stock is up by a whopping 482% so far this year.

Sensus Healthcare has watched prices lift 260%, and Target Hospitality, which provides temporary housing for employees of various companies, is up 241%.

These shares are even more profitable when compared to other top US indices because it includes such a wide array of companies.

Finding promising companies for mid and long-term investments can be hard work. But, even during this crisis, it’s not mission impossible by any means. As with any trade, always look first (at the company’s profile) then leap.