When something unexpected comes up, it’s always helpful to have a few ways to pay for it without dipping into your savings. You can simply get payday loans to solve your problem. Here are four easy ways to pay for unexpected expenses.

1. Apply For A Payday Loan To Cover An Unexpected Expense

If you’re like most people, you probably don’t have a lot of money saved up for emergencies. So what do you do if you suddenly find yourself faced with an unexpected expense?

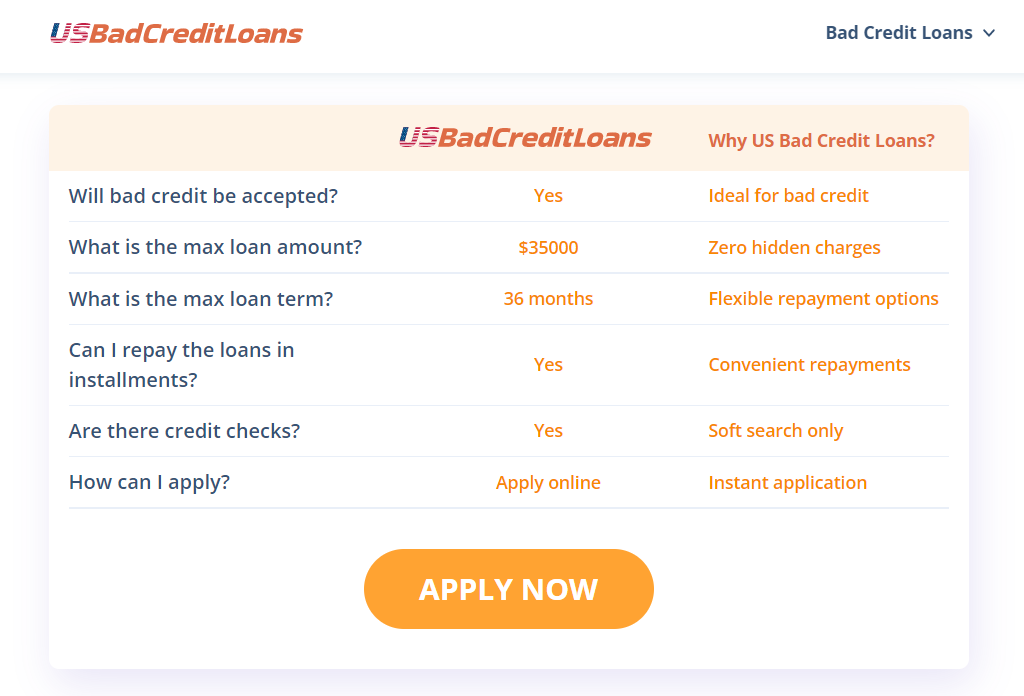

One option is to apply for a payday loan. Payday loans are short-term loans that are typically due on your next payday. They are designed to help people cover unexpected expenses, such as medical bills or car repairs.

One of the benefits of a payday loan is that you can get the money you need quickly. You can usually apply for a loan online and have the money deposited into your bank account within a few hours. Another benefit of payday loans is that they have a relatively low-interest rate. This means that you won’t have to pay a lot of money in interest if you borrow money for a short period of time.

However, there are some drawbacks to payday loans. One is that you may have to pay a fee to borrow the money. Additionally, if you don’t pay back the loan on time, you may have to pay a penalty.

So if you find yourself in a bind and need some quick cash, getting a payday loan from US Bad Credit Loans may be a good option. Just be sure to read the terms and conditions of the loan before you apply for a broker like US Bad Credit Loans, so you know what to expect when applying for a bad credit loan from loan brokers.

2. Using Your Credit Card To Cover Emergencies

Your credit card can be a lifesaver in an emergency. Here are some tips on how to use it to cover your expenses. If you’re ever in a bind and need some extra cash, your credit card can be a lifesaver. Here are a few tips on how to use it to cover your expenses:

A. Use your credit card to pay for unexpected costs

Unexpected costs like a car repair or a vet bill can be a huge financial burden. If you don’t have the cash on hand to cover them, you can use your credit card to pay for them. This will help you avoid costly interest charges and get you back on your feet fast.

B. Use your credit card to pay for your monthly expenses

If you’re tight on cash, you can use your credit card to pay for your monthly expenses. This can help you keep your head above water until your next paycheck comes in. Just be sure to pay off your balance in full when your statement arrives, so you don’t end up paying interest.

C. Use your credit card to build your credit history

If you’re trying to build your credit history, using your credit card is a great way to do it. By using your card and paying your bill on time every month, you’ll slowly but surely build up a good credit history. This will make it easier for you to get approved for a loan or a mortgage in the future.

So if you ever find yourself in a tight spot, don’t hesitate to use your credit card. It can be a lifesaver in a crisis.

3. Borrow From A Friend Or Family Member To Pay For Unexpected Expenses

Borrowing money from a friend or family member can be a touchy subject, but it can also be a lifesaver in a pinch. If you’re faced with unexpected expenses and you don’t have the money to cover them, borrowing from a loved one may be your best option. There are a few things to keep in mind if you decide to borrow money from a friend or family member.

First, be sure to discuss any interest rates or repayment terms upfront. Next, be sure to make repayments on time so you don’t damage your relationship. Finally, be sure to thank your friend or family member for their help.

If you’re facing a difficult financial situation, borrowing from a friend or family member may be a good option. Just be sure to discuss the terms of the loan upfront, and make repayments on time to avoid any negative consequences.

4. Request A Salary Advance To Cover Unexpected Costs

When you’re faced with an unexpected expense, it can be difficult to cover it without going into debt. If you need a little help to cover your costs, you may be able to request a salary advance from your employer. Many employers offer salary advances as a way to help their employees cover unexpected costs. This can be a great way to avoid going into debt or to pay off an existing debt.

If you’re thinking about requesting a salary advance, there are a few things you need to know. First, you’ll need to have a good reason for needing the advance. Your employer may be more likely to approve your request if you can provide a valid reason, such as an unexpected medical bill or car repair.

You’ll also need to have a good credit history. Your employer may check your credit score before approving your advance. If you have a good credit score, your employer is more likely to approve your request.

If you meet these requirements, you can request a salary advance from your employer. This can be a great way to cover unexpected costs without going into debt or you could again ask for a loan from a trusted source like US Bad Credit Loans.